July 27, 2019

By Pankaj C. Kumar

JUST about a month ago, the National Property Information Centre (Napic) released the Malaysian housing data for the first quarter (Q1) period ended 2019. There are several interesting findings from the state of the Malaysian property market in the first quarter, especially for homebuyers but definitely not for developers, as overhang remains elevated.

The good news is that the Malaysian median home prices have now declined to RM268,000, which is the level last seen five years ago in 2014 when median prices were at RM270,000. First quarter 2019 median price was also 11.6% and 9.7% lower than the peak price of RM303,000 and RM296,944 in 2017 and 2018 respectively.

However, if one thinks that prices are lower, the Malaysian House Price Index (HPI) paints a different picture. For Q1 of 2019, the HPI fell by 0.9% on a quarter-on-quarter (q-o-q) basis to 193.6 points but the index is still 1.3% higher when compared with the Q1 2018 reading of 191.2 points. In addition, even the mean home prices of RM339,780 is about 26.8% higher than the median price. So, while buyers can rejoice of lower median prices, mean prices are still sticky as more transactions and supplies are clustered towards the affordable market segment.

Geographically, the Malaysian HPI was dragged lower on a q-o-q basis mainly due to drops across the country with the exception of Penang, where the HPI rose by 1.1%. On a year-on-year (y-o-y) basis, the positive annual change was highest in Perlis, Kelantan and Johor at 8.8%, 5.4% and 5% respectively while negative growth was experienced by Sarawak, Terengganu and Kuala Lumpur with falls of 1.6%, 1.5% and 1.2% respectively.

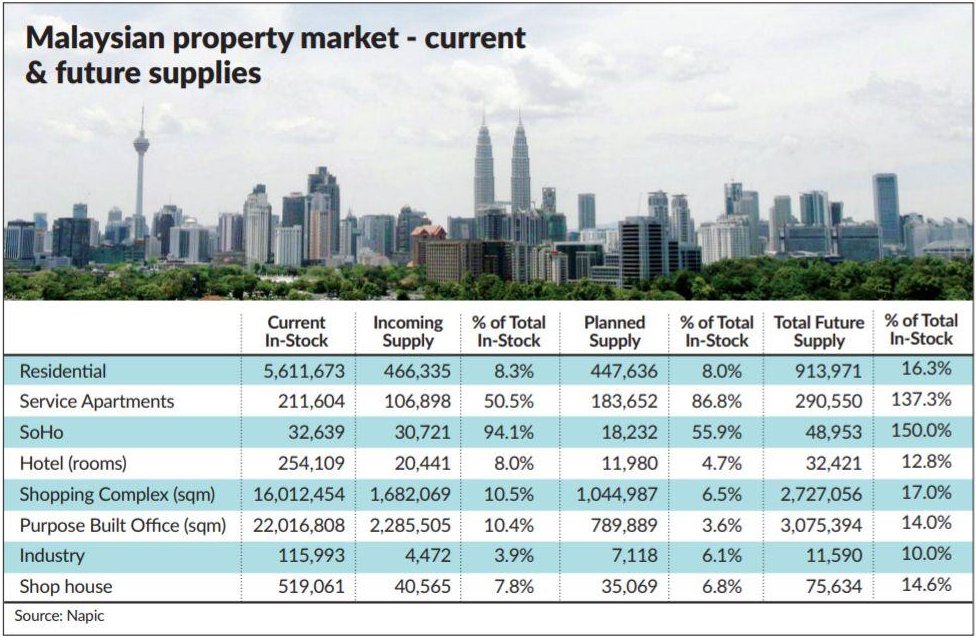

Malaysian Property Market – Current & Future Supplies

House prices remained very much unaffordable for most Malaysians as All House Price for Malaysia as at Q1 of 2019 stood at RM417,670 with only six states showing their respective All House Price index at below RM250,000. The six states include Kelantan, Melaka, Perlis, Perak Kedah and Pahang with prices ranging between RM181,860 and RM225,073 while Kuala Lumpur, Selangor and Sabah are the top three most expensive locations with All House Price in ringgit at RM779.448, RM477,816 and RM440,486.

On types of residential properties, terrace homes remained strong, despite a 1% decline in the HPI to 205.4 pts in the Q1 of 2019 against the preceding quarter. Nevertheless, the reading was still higher by 2.6% on a y-o-y basis. Strong price growth was recorded in Johor and Penang as prices rose by 0.4% and 1% q-o-q and 9.5% and 3.6% y-o-y respectively.

Terrace homes, if measured as affordable based on a price tag of RM250,000 and below, is seen well within reach in nine states with the exception of Kuala Lumpur, Selangor, Johor, Penang, Sabah and Sarawak.

For high rises, prices were little changed in the Q1 as they dropped 0.5% q-o-q but were higher by 0.2% y-o-y. These high rises are only affordable in places like Johor, Negri Sembilan and Melaka as the unit prices for these states were below RM250,000.

As widely reported, Malaysia’s overhang issue remained elevated at the end of Q1 of 2019 with both number of units and value rising by 5.5% and 4.1% q-o-q to 54,708 units valued at RM37.23 billion.

Residential and serviced apartments make-up the majority of these unsold completed stocks, accounting for 61% and 24% in number of units or 85% in total, and 54% and 27% in value or 81% of total overhang value. States with the highest overhang are Johor, Selangor, Perak, Kuala Lumpur and Penang with total overhang of about 74% in number of units and 83% in value of the total.

In terms of type of properties in the residential segment, it seems the pattern is similar across the market. Some 37.7% are unsold in the detached and semi-detached segment, 28.9% across terrace homes and 24.9% in the high-rise segment and 23.8% are others. In terms of price points, the two largest categories are homes that are priced between RM300,001 and RM500,000 and RM200,001 and RM300,000 where some 8,337 units and 7,506 units that are completed but remained unsold respectively. The total units in these two price segments alone makes up about 48% of the overall overhang in the residential property segment although in terms of value, they account for about 25% of the total. In terms of value, bulk of the overhang is in the pricier properties as properties that are more than RM700,001 and above has total overhang value of about RM11.49bil, accounting for almost 58% of total overhang in the residential segment.

What is interesting is that despite the gloomy picture in terms of unsold properties, developers continue to launch their products in the market and Napic statistics showed that even after nine months since launched, sales have been rather poor with only about 39.8% of the 32,563 units sold.

Sales for units that are priced between RM300,001 and RM500,000 are doing reasonably well with just under 52% sold after nine months of launch while properties above a million ringgit are less than 25% sold after three quarters since launch.

In terms of stock, incoming and planned supply, the residential market presently has the highest stock but the future supply is not that alarming with about 8.3% in the incoming supply bucket while another 8% in planned supply. Within the residential segment, the high-rise segment is the biggest cluster in terms of future supply with 184,092 units in the bucket of incoming supply and 178,646 units in the bucket of planned supply. On a combined basis for the high-rise segment, the total 362,738 units that are expected to flood the market is more than the 350,538 units terrace homes that are expected to be completed in the future.

The worrying figures in percentage terms are from both the service apartments and SoHo units where the combined future supply is 137.3% and 150% of existing stock level. Of course, some of these planned supplies may not materialise if the developers continue to delay the launch of their projects but the incoming supplies looks troubling still as they make up 50% and 94% of current stock level. This can be seen from the table depicting the state of supplies of the Malaysian property market.

The picture painted by the housing statistic suggests that while the market has seen some pick up in activity, judging by an uptick in both total number of transactions and value, the housing market remains under pressure for developers to off-load their stocks while the incoming and planned supplies are main future stumbling block for the market to see recovery anytime soon.

For buyers, the choices are aplenty especially in the affordable market segment, a segment that every sizable developer has been focusing on while in terms of choices, indeed prices in the main cities remains beyond the reach of the average home buyer but the overall picture in certain states remain attractive for home owners to have a roof over their heads.

Furthermore, with the extension of the Home Ownership Campaign (HOC) to the second half of 2019, having a home has become more affordable due to the discounts thrown in by developers as well as absorption of cost associated with buying a property from developers. Overall, home prices have become more affordable due to not only the current stock level, but also due to the income supplies in the affordable price buckets. But sadly, they are mainly not in the prime city areas. Hence it all depends where these homes are located and the type of residential supply.

The views expressed here are that solely that of the writer.

References: thestar.com.my